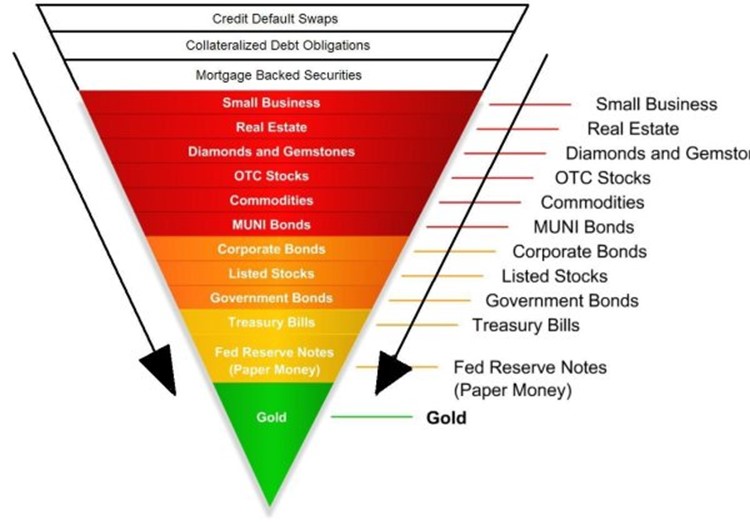

John Exter’s inverted pyramid. The idea is that things high on the pyramid are derivatives of asset classes further down the pyramid. From FOFOA.

Note that in FOFOA’s expanded version of Exter’s inverted pyramid there are all sorts of derivatives at the top of the inverse pyramid. Those derivatives were wildly inflated and at one pointed passed the one quadrillion mark, which is greater than the value of all physical, privately-owned assets on Earth. See yesterday’s China authorizes state banks to renege on commodities derivatives.

How is that possible? It’s possible because derivatives and paper markets are often larger than the underlying physical markets. See paper oil vs. physical oil markets and paper gold vs. physical gold markets.

In a nutshell, the notional value of the paper market can be much larger than the underlying physical assets. Imagine a desert island with one coconut tree that produces one coconut per year.� Now imagine that somehow that one coconut is supporting a hundred firms trading coconut stocks, coconut bonds, coconut futures, and coconut derivatives. All of that activity is resting on an inverted pyramid supported by a single coconut per year. Like gold, the coconut is real. The farther away from the coconut you go in the pyramid the more derived and abstract the value of the asset and also the larger the market, because the paper market is puffed up with hot air, empty promises, Armani suits and horseshit.

Anyway, the theory is that when asset values are inflated and risk is perceived as low money moves up the inverted pyramid (away from cash, gold and coconuts).

During a debt deflation (which is what we are in now), a panic, or a perceived high risk environment money moves down the inverted pyramid (towards cash, gold and coconuts, as well as other more fundamental, less-derived assets).

I agree with FOFOA that gold is not a commodity in the usual sense. Commodities are things that are consumed – wheat is eaten, oil is burned. Gold has some commodity uses in jewelry and industrial processes, but those uses are dwarved by its use as a store of a value and a form of currency. Even gold in jewelry isn’t really used up – it can be scrapped and re-used.