-

By William Watts, www.marketwatch.com

-

December 14th, 2016

Stock investors clearly aren’t sweating rising bond yields. Instead, they are pushing major indexes to a string of new records despite a brutal rout in bonds.

But why isn’t there more worry about rising yields? After all, it would be natural to fear that a rapid rise in rates—the yield on the 10-year Treasury note TMUBMUSD10Y, +0.00% has jumped more than a percentage point from its midsummer bottom and was trading near a two-year high on Tuesday—could slow the economy. Yields rise as debt prices fall.

Stocks have been on a tear, adding to gains since Donald Trump’s presidential election victory on Nov. 8. The S&P 500 SPX, -0.18% is up 3.3% in December alone and on track for a year-to-date gain of more than 11%, while the Dow industrials DJIA, -0.04% up 14.3% year-to-date, are a whisker shy of the psychologically important 20,000 milestone.

The answer, according to many investors, has to do with the starting point for yields. The rise has come from historically low levels. A 10-year yield near 2.5% is still quite low.

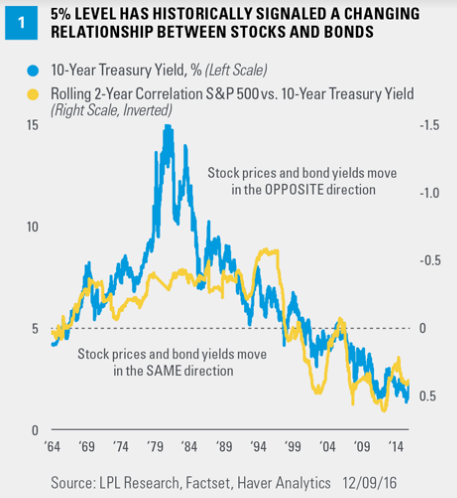

Burt White, chief investment officer at LPL Financial, made that point in a Tuesday note, then took it further. White, in the chart below, explains that, historically, when the 10-year yield is below 5%, the correlation between stocks and bonds has been positive. Above 5%, the correlation turns negative.

© 2016 Dow Jones & Company, Inc.

The content you have chosen to save (which may include videos, articles, images and other copyrighted materials) is intended for your personal, noncommercial use. Such content is owned or controlled by Dow Jones & Company, Inc or the party credited as the content provider. Please refer to marketwatch.com and the Terms of Service available on its website for information and restrictions related to the content.