Millennials ought to be 100% invested in stocks, says top-ranking newsletter editor

Published: May 7, 2017 7:25 a.m. ET

Younger people have decades to build wealth, and they shouldn’t squander precious time

Wealth can rocket when you invest in equities.

Our solution to the problem of millennial investors mistrusting investment advisers prompted a huge response from readers. But it also led to an even more important question: What about millennials, those aged 18 to 35, who hold no stocks?

Those younger people ought to listen to John Buckingham, editor of the Prudent Speculator newsletter, which has a No. 1 ranking for performance since inception 40 years ago from the Hulbert Financial Digest. Mark Hulbert wrote in a Barron’s article in February that the newsletter’s «advice has made more money over the past 40 years than any of the nearly 200 other services» he monitors.

Buckingham, who’s been in investment management for 30 years, shared with us a set of numbers that clearly shows how important it is to invest in stocks and remain committed for decades. The result: almost guaranteed wealth.

«If you are 50 or younger, or have 10 years before taking money out, and do not have 100% in equities, you are crazy.»John Buckingham, editor of the Prudent Speculator

Only one in three millennials was investing in the stock market, according to the results of a study released by BankRate.

A reason many millennials may be steering clear of stocks is that «the two big declines in the 2000s colored the opinions of a whole generation of investors,» Buckingham said in an interview in New York on April 27. «If you actually look at the raw numbers [going back to 1927], you will see that continuing to buy over time, independent of what the market is doing, will be rewarding.»

Buckingham doesn’t try to time the market; he sticks with his stock-selection strategy. In addition to his newsletter, Buckingham and his team manage money following the Prudent Speculator strategy through AFAM Capital.

Here’s Buckingham’s set of numbers. It’s a list of average annual returns by asset class from June 30, 1927, through Dec. 31, 2016, along with the average inflation rate:

| Asset class | Average annualized return | Standard deviation |

| Value stocks | 13.5% | 26.1% |

| Growth stocks | 9.2% | 21.5% |

| Dividend-paying stocks | 10.5% | 18.2% |

| Non-dividend-paying stocks | 8.6% | 29.8% |

| Large-company stocks (S&P 500) | 9.9% | 18.9% |

| Small-company stocks (bottom 20% of New York Stock Exchange) | 12.1% | 28.6% |

| Long-term corporate bonds | 6.0% | 7.6% |

| Long-term government bonds | 5.5% | 8.5% |

| Intermediate government bonds | 5.1% | 4.4% |

| Treasury bills | 3.4% | 0.9% |

| Inflation | 3.0% | 1.8% |

| Sources: Al Frank Investment Management, using data from professors Eugene Fama and Kenneth French, and Ibbotson Associates | ||

Buckingham said he defines value stocks by using price-to-book-value ratios for companies. The less expensive half of all stocks, by this measure, he calls value stocks.

Look at the table — the numbers are astounding. Over the long haul, there’s no question that the four categories of stocks have greatly outperformed all other classes of securities. The standard-deviation column shows the stocks have more price volatility than the other classes. So this is the big stumbling block that keeps some people out of the market.

The Prudent Speculator

John Buckingham, editor of the Prudent Speculator.

Millennials, and anyone else for that matter, must not only tolerate price volatility, but expect it. The rewards for doing so are enormous.

The Prudent Speculator follows a value-based approach and has a strong track record to back it up. Another option is to use low-cost index funds that track broad indices, such as the benchmark S&P 500 SPX, +0.41% and also growth or value indices. Here are a few examples:

• The Vanguard 500 Index Fund VFINX, +0.41% tracks the S&P 500 of the largest U.S. stocks.

• The iShares Russell 1000 Value ETF IWD, +0.53% tracks the Russell 1000 Value Index.

• The iShares Russell 1000 Growth ETF IWF, +0.37% tracks the Russell 1000 Growth Index.

Volatility is not your enemy

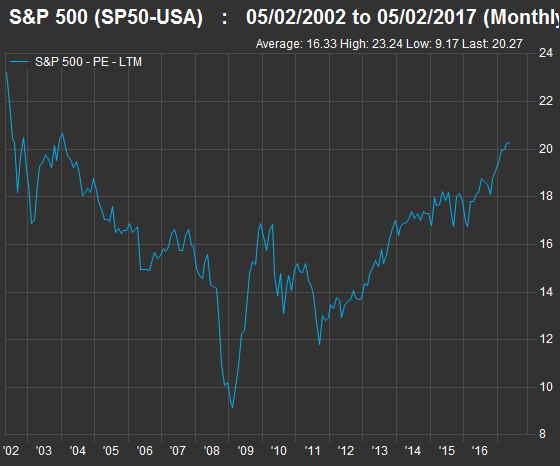

You may see financial-media headlines that say stocks are overvalued eight years into the current bull market. If we look at trailing price-to-earnings ratios for the S&P 500, we indeed see valuations climbing:

FactSet

FactSet

The index now trades for 20.3 times the past 12 months’ earnings, the highest since January 2004. If you exclude the energy sector, stocks actually are cheaply valued.

But consider the alternatives. Right now, you can buy 10-year U.S. Treasury notes that yield about 2.3%. The S&P 500’s dividend yield is 2.01%. So if you buy Treasury paper, you gain only a slight amount of yield for giving up all of that long-term growth potential.

If you react to media hysteria, you will be tempted to «buy high and sell low.» Following a trend means you buy high, as it’s pretty certain that the media will not be at the forefront of an investing trend. If you panic and sell after a market decline, your losses will be locked in. Then you might be afraid to jump back in to enjoy a market recovery. The Prudent Speculator’s results have shown the benefit of keeping calm and staying invested.

Another important thing to keep in mind is that if you are building wealth over several decades by making regular investments or contributions to an employer-sponsored retirement account, you pay lower prices during periods of decline for the stock market. And you might even be enjoying matching contributions from your employer that guarantee returns on every investment you make from day one.

You will see constant warnings of a «correction» for stocks (usually defined as a decline of at least 10%), or a bear market, which typically means a decline of 20% or more. But, again, this type of move must be expected, and if you are making regular investments, it helps you beat the performance of the overall market.

According to Buckingham, «there have been corrections of 10% or more in 24 of the [past] 40 years,» with the S&P 500 ending up with positive returns for all but 10 of those years.

Here’s a two-year chart for the S&P 500:

FactSet

FactSet

The index has risen 13.3% and returned 18.3% with dividends reinvested, over the past two years. But there have been two 12% declines. So if you had made regular investments each pay period during those two years, your performance would have been boosted by those dips. And if you had a matching contribution from your employer, so much the better.

Going back to the table, let’s imagine you could average a 10% annual return. With compounding, that means your money doubles in seven years. But if you are making period investments the entire time, with matching contributions from your employer, and factor in the market dips when you pay lower prices, you have the potential to construct a pot of gold much faster than you may have expected.

«For retirement planning, if you are 50 or younger, or have 10 years before taking money out, and do not have 100% in equities, you are crazy,» Buckingham said.