Mar 24, 2017

People always have a favorite indicator — maybe a bum knee that signals a storm’s a-comin’.

For markets, the latest danger sign might come from a rookie president going for a make-or-break vote on a big health-care bill.

Analysts are worrying about what might happen if the former casino owner’s roll of the dice today doesn’t work, even as stock futures trade higher.

«If equity markets are looking for a reason to sell off, this could very well prove to be the trigger,» says TopTradr’s Tony Cross.

But Citi strategists aren’t fretting much about Trump trades collapsing. They are finding solace in an indicator tied to the job market, which delivers our call of the day.

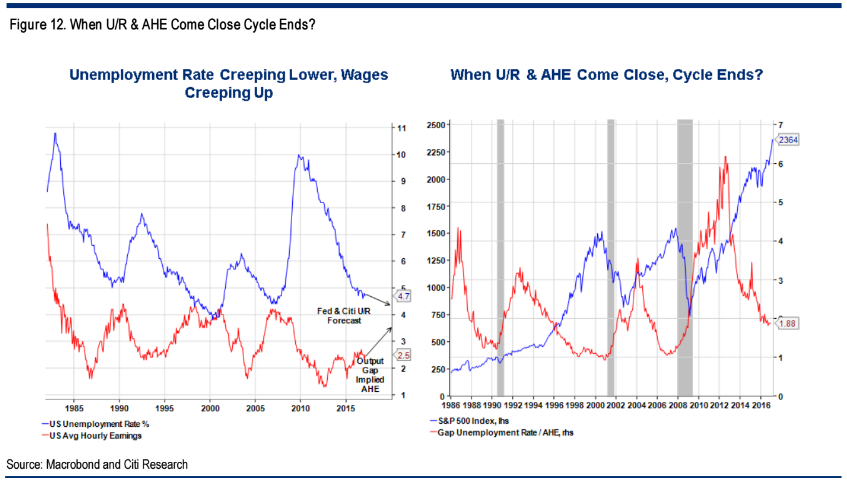

«For a major correction/end of bull market signal, one useful guide is to look at the ratio of unemployment and wage growth,» says the bank’s global asset allocation team. «When the two cross historically, the business and market cycle often turns less positive.»

The cross for the U.S. «seems more than a year away,» says the team, led by Jeremy Hale.

Citi’s chart below shows how the convergence doesn’t look imminent — and how prior crosses roughly coincided with the S&P 500’s peaks in 2000 and 2007.

Citi

Citi

The warning also might come from growth in average hourly earnings (AHE) rising to 4%, the strategists say — but that’s not occurring yet either. Monetary policy remains supportive, the team notes, and headline inflation should ease in the next 12 months to keep that particular prop in place.

«We would be inclined to buy a dip in risk assets,» the Citi team says.