Published: June 14, 2017 2:52 p.m. ET

The latest data reinforces how complex and actively managed funds underperform

If you had to distill the best possible investment strategy to one sentence, you could do worse than the following: keep it simple, and don’t worry about trying to beat the market, because odds are you can’t.

More often than not, the simplest investments are the best ones for investors, according to a new study by professors at the Smith School of Business, who argue that the mutual funds that use more sophisticated investing instruments and strategies—including leverage, short sales, and options—aren’t able to leverage that complexity into better investor gains.

Such complex instruments «are often used by poorly monitored funds, and are associated with poor outcomes for investors such as lower performance, higher idiosyncratic risk,…and higher fees,» the study read. «Consistent with moral hazard, we also find that mutual funds that use these instruments hold riskier equity positions.»

It added: «Mutual funds attempt to use complex instruments to reduce the risk of their portfolios but in an imperfect and costly way.»

These instruments are prevalent in the mutual-fund industry; over the past 15 years, according to the study, more than 40% of domestic-equity funds reported using at least one of them, and in general, these funds fared far worse, with a lower annual excess return of 0.59%.

The results are even worse when you consider that they charge higher fees, which can further erode any potential profit. Funds that use complex instruments charge annual fees that on average are 0.072% higher than funds that choose not to use them, and 0.19% higher than the funds that aren’t allowed to use them—for example, passive equity funds, which have to mimic the holdings of an underlying index like the S&P 500 SPX, +0.03% and tend to charge the lowest fees of any category.

Passive funds are seen as the simplest investment instrument that can offer broad-market exposure, and in part due to that fact, they have a nearly unbeatable record over long periods of time, particularly when their lower fees are taken into account.

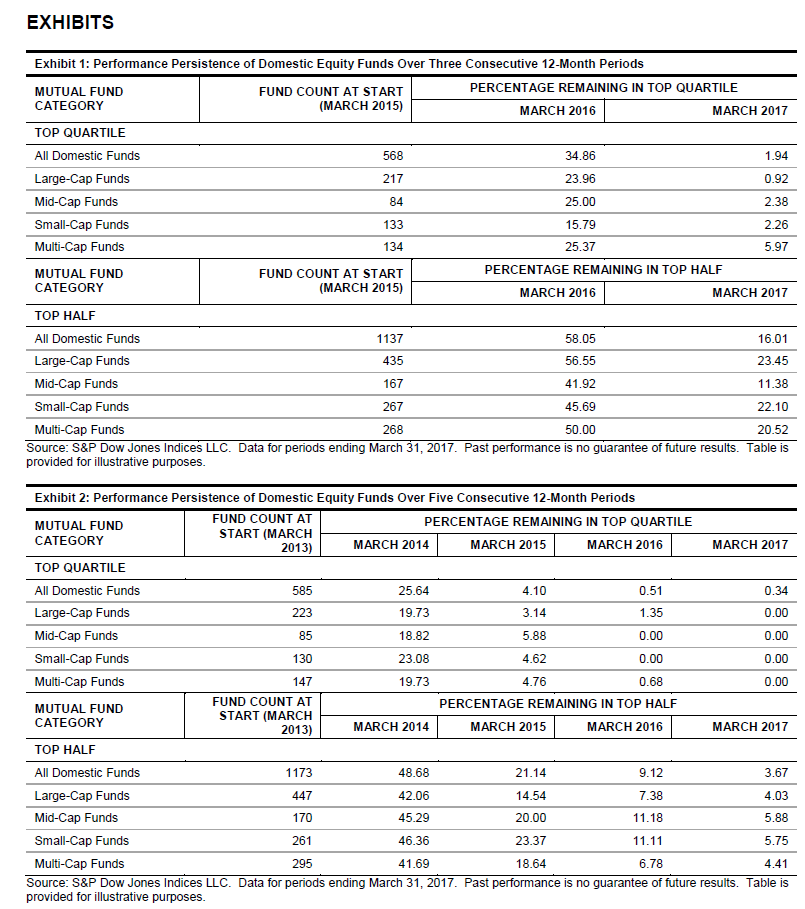

According to S&P Dow Jones Indices, of the 568 actively managed domestic stock funds that were in the top 25% of performance in March 2015, fewer than 2% managed to stay in there at the end of March 2017. For more detail on how many funds in different strategies remained in the top quartile of performance over different time periods, see the following chart from S&P Dow Jones Indices.

In actively managed funds, the holdings are individually selected and weighted by one or more managers. Data have repeatedly shown that the number of active funds that can consistently beat the market over the long term is essentially zero. As a result, investors have been moving to passive funds en masse. According to Morningstar, active funds saw outflows of $285.2 billion in 2016; passive funds attracted inflows of $428.7 billion.