Published: Feb 9, 2018 7:55 a.m. ET

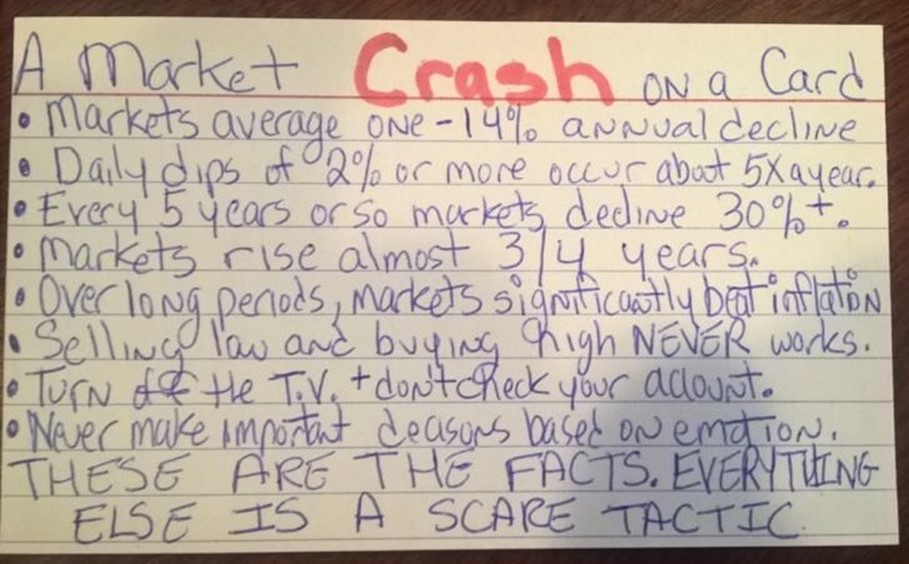

‘Never make important decisions based on emotions’

Getty Images

The recent turbulence in the U.S. stock market no doubt has a lot of investors searching for a strategy to navigate the volatility and protect their capital. The good new: The best tactic most investors can take is easier than they may expect.

In fact, according to one adviser, the important things to keep in mind are so simple they can fit on a single note card. Such a card was tweeted Thursday by Ritholtz Wealth Management, which credited it to Anthony Isola, a financial adviser at the firm who tweets under the handle @ATeachMoment.

Several of the bullet points underline how this week’s heavy volatility — in contrast to the historically quiet markets seen over 2017 — is the norm for equities. «Daily dips of 2% or more occur about 5x a year,» the note reads, adding that markets average one 14% drop a year, and that there’s a drawdown of at least 30% every five years.

Over the long term, however, such declines are erased by the general uptrend of equity markets. «Over long periods, markets significantly beat inflation,» the card reads, noting that historically, markets tend to rise in almost 75% of years.

Read: Here’s how the stock market typically performs in the aftermath of a major rout

The trick, then, is to avoid making portfolio decisions based on short-term swings and movements. Data have repeatedly shown that those who trade excessively tend to show much worse performance than the buy-and-hold investors who mostly sit tight and reap the benefit of compound interest.

«Never make important decisions based on emotions,» the card reads. «Turn off the T.V. and don’t check your account.»

That’s particularly good advice today, considering the Dow Jones Industrial Average DJIA, +1.38% and the S&P 500 SPX, +1.49% both fell into correction territory on Thursday, meaning they are down 10% from a recent peak.